Real Estate Articles

Amortization in Real Estate

Written by Brent Pace for Gaebler Ventures

When buying real estate, most investors specify a holding period. To determine your potential profits at sale you will need to build an amortization table.

Most real estate investors purchase real estate with a specified hold period in mind, such as 5 or 10 years.

As an entrepreneur who is purchasing real estate, it might be wise to consider the same strategy for your business. When you purchase a property, you want to use your hold period and estimate what gain you will make on the property at sale. To do this properly you will need to put your loan into an amortization table to see what the remaining balance will be at sale.

Why hold for 10 years?

Unlike home mortgages, most commercial real estate loans only have a 10 year term. For instance, a typical commercial loan will have a 30 year amortization schedule, but will require you to re-finance at the end of the 10-year term. If you get a typical mortgage on your commercial real estate, you will want to plan so that you know your balance at the end of the 10th year and can figure out any potential profits you might realize.

Model your loan

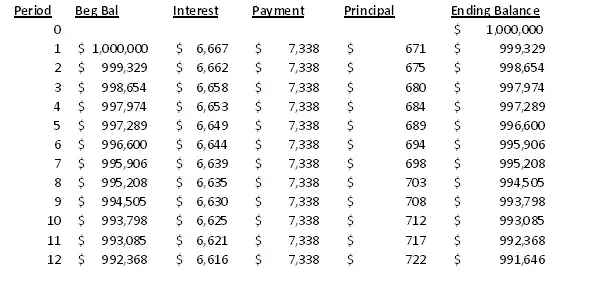

One easy way to start is by modeling your mortgage loan. The simplest way to do that is with a table in Microsoft Excel. Suppose you have a loan for $1 million with 8% interest. The loan is a 30-year amortization, but a 10-year term. Here is an example of what the first year of the loan would look like when modeled in excel (remember, each payment is one period, so twelve periods represent one year).

Compute your gain from amortization

If you complete the table above, you will find that at the end of ten years you will have a balance of $877,247 on your loan. If, instead of refinancing, you sell your property, you can then compute your gain. To make the example simple, let's assume that your property is now worth $1.5 million. Instead of having a $500,000 gain, the benefits of amortization have allowed you to reap around $613,000.

Brent Pace is currently an MBA candidate at University of California at Berkeley. Originally from Salt Lake City, Brent's experience is in commercial real estate development and management. Brent will have tips for small business owners as they negotiate their real estate needs.

Share this article

Additional Resources for Entrepreneurs

Conversation Board

We greatly appreciate any advice you can provide on this topic. Please contribute your insights on this topic so others can benefit.