Sell a Business for the Best Price

Selling a Propane Engine Conversion Business

It's a misconception that no one is buying propane engine conversion businesses these days. Savvy entrepreneurs see propane engine conversion business opportunities as a path to short-term profits and long-term growth. There aren't any guarantees, but if you adhere to fundamental business sale concepts, you can likely get a good price for your business.

The business-for-sale market is just as frustrating for buyers as it is for sellers these days. There are lots of buyers who want to own a propane engine conversion business, but have limited capital to get their foot in the door.

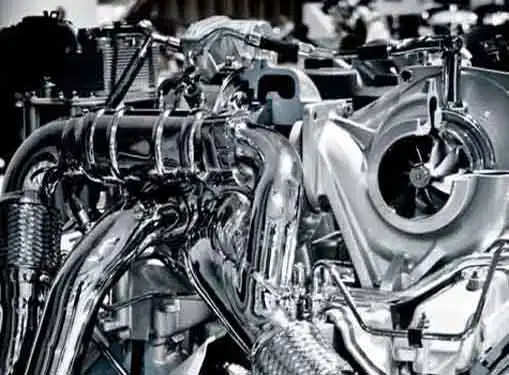

By converting existing vehicles to propane, propane engine conversion businesses give consumers a viable alternative to traditional fuel sources.

They require careful planning and an intentional strategy that emphasizes your propane engine conversion business's strengths and meets the needs of the marketplace. But for business sellers, the process begins with having the right mental attitude.

The Emotions of a Business Sale

Business sellers sometimes struggle to handle the emotions of a sale. You probably have good reasons for selling your propane engine conversion business now, but that doesn't make the emotions you will experience any easier. It's important to allow yourself time to process your emotions during your exit. At the same time, it's helpful to consult with people who can help limit the influence of your emotions on negotiations and other aspects of the sale process.

Tips for Working with A Business Broker

Brokerage is a mainstay of the business-for-sale marketplace. Brokerage is particularly common in the propane engine conversion business-for-sale market, where aggressive selling strategies are the norm. However, your broker will still expect you to materially participate in the sale of your business. To maximize your broker's potential, conduct periodic consultations throughout the process and deliver requested information as quickly as possible.

Valuation Methods

Professional appraisers can use three methods to determine the value ofa propane engine conversion business: The income method, the asset method and the market method. While the income method uses anticipated revenues as a value basis, the asset method focuses on the company's capital, real estate and intellectual assets. In many sales, the most accurate valuation comes from the market method which determines value based on the recent sales of similar businesses. A good appraiser will often use multiple valuation methods to arrive at a reasonable estimate. But regardless of the method that is used, it's always in the seller's best interest to increase revenue and asset values prior to a sale.

Share this article

Additional Resources for Entrepreneurs