Selling a Company Advice

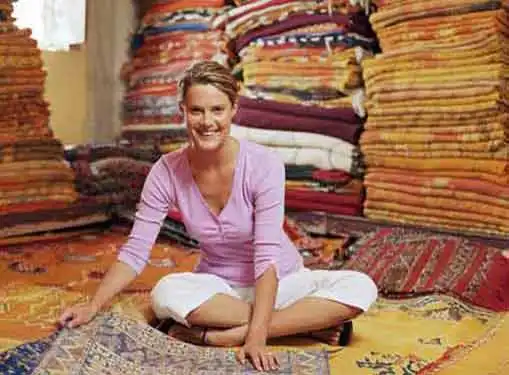

Selling a Used Carpets and Rugs Business

Most businesses are susceptible to economic conditions and used carpets and rugs businesses are no exception. But in some cases, a down economy can actually improve saleability. To increase your company's sale price, you'll need to perform adequate preparations, positioning it to the catch the eye of profit-minded buyers.

If you listen to many entrepreneurs, there never seems to be a good time to put a small business on the market.

Most used carpets and rugs businesses are good business opportunities, a fact that is not going unnoticed by today's discerning buyers.

Equipment and Inventory Concerns

It's incumbent on buyers to commission their own appraisal of your used carpets and rugs business's physical assets. Most sellers, however, conduct a pre-sale appraisal to gain an accurate gauge of asset value prior to negotiations. A pre-sale appraisal is a prerequisite for because it offers insights about your assets' market value before you initiate conversations with prospective buyers. When you conduct your appraisal of your assets, note their condition and include it in the information packet you prepare for prospective buyers.

Setting the Stage

A successful used carpets and rugs business sale begins with careful planning. Although you are convinced your business has value in the marketplace, the planning process establishes a framework for communicating its value to prospective buyers. Professional business brokers understand buyers and know how to properly communicate a used carpets and rugs business to the marketplace. Specifically, brokers can advise you about the preparation of financial statements and other documents buyers expect to see in a premium used carpets and rugs business opportunity.

Brokerage Benefits

A good broker can offer several benefits to business sellers. First, business brokers are in tune with the realities of the market and are skilled at helping owners make their businesses attractive to premium buyers. More importantly, brokers have the ability to identify serious buyers and maintain confidentiality throughout the sale process. Typical brokerage rates (a.k.a. success fees) run 10% of the final price - an expense that is usually recouped through a higher sales price and less time on the market.

Share this article

Additional Resources for Entrepreneurs