Accounting

Breaking Down Break-Even Analysis Part -1

Written by Farhaa Xha for Gaebler Ventures

This article aims to equip entrepreneurs with an important analytical tool of financial decision making.

What is Break-Even Analysis?

"Breakeven Analysis is the analysis of the level of sales at which a business (or a project) would incur zero profit." i .e. The levels of output or sales where total costs (fixed and variable) and total revenue are exactly the same, this is known as the 'break even point'.

This analysis aids to answer questions such 'What is the minimum level of sales required to ensure the firm doesn't incur losses?" or "How much can sales be reduced and the firm still continue to function profitably?"

Break-even analysis is also known as cost-volume-profit (CVP) analysis.

Why do I need to calculate?

Break even analysis mainly highlights the importance of fixed cost in running a business. This is a type of statement normally not produced by your accounts officer; nevertheless it is a significant management tool which is easier to understand, simple to calculate, and a good indicator of a firm's financial health. Break even analysis simply answers the most important question - How many hours or products your business has to sell to cover its costs?

Most small and new firms liquidate simply because businesses did not possess sufficient cash to build a business that could be financially sustainable, in other words, achieve a break even point.

Breakeven tells us the level of output that is required before profits are made, as well as the level of output required to produce a certain level of profits.

Not knowing our break even point and length of time it would take to reach that point we will not be able to compute the working capital required to provide for to ensure financial security.

What Else Can I Find Out By Conducting Break Even Analysis?

Well, firms use break even analysis to:

1. Calculate in advance the level of sales required to break even or to provide a profit

2. How variations in output affect profit

3. How variations in price affect the break even point (BEP) and the level of profit

4. How changes in costs ( either fixed or variable ) affect the BEP and level of profit

5. If we can accept an order below standard selling price

What information do I require to Calculate BEP?

Projected average per-unit revenue is the number you need.

This is the price you would obtain by selling a unit, (accounting for trade discounts and special offers as well). Where would you get this number? From your Predicted Sales i.e. Sales forecast. In this analysis you need a single sales figure, so if you produce and sell more than an item you would have to compute the average of all sales. If your business is non unit based, construct the per unit revenue $1 and take your costs as a percent of a dollar.

Projected variable cost of production per unit (VC)

This is the average raise of the total cost caused by incrimination of the production by one unit. i.e. extra cost of producing another unit. Your variable cost may comprise of but not limited to:

1. The wages of labor involved - Direct Labor

2. The cost of raw materials used in production, in accounting terms, known as "Direct materials"

3. Expenses varying with the number of units produced e.g. energy bill, known as "Variable Production Overheads"

4. Other direct costs - e.g. royalty payments

Monthly fixed costs

In break even analysis the term fixed cost refers to the costs that do not change in the short term as function of changes in production volumes, distribution volumes, labor or machine hours, which implies business cost remains constant regardless of the level of operating activity or production, e.g. Rent, property taxes, interest expenses .

However you may take account of usual running fixed costs, including Operating Expenses like payroll. This will produce a more realistic outcome.

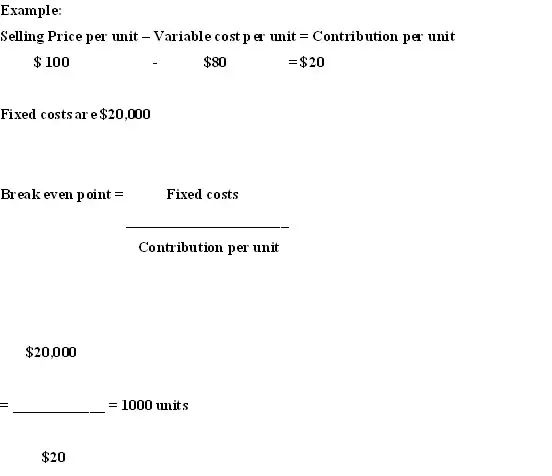

Calculating BEP using contribution

Contribution is the amount of money left over after the variable cost per unit is taken away from the selling price. Contribution can be used to pay the fixed cost incurred by the firm. Once these have been met fully, contribution provides a business with its profits.

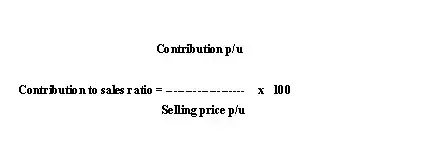

Contribution can also be expressed as a percentage of the selling price, known as the Contribution margin. The formula is known as 'contribution to sales ratio'.

Farhaa is a student pursuing a concentration in Economics and Finance at London school of Economics and Political Science, University of London. She is passionate about making accounting and economics accessible to entrepreneurs. Farhaa will also be sharing unconventional yet effective ways of recruiting.

Share this article

Additional Resources for Entrepreneurs

Conversation Board

We greatly appreciate any advice you can provide on this topic. Please contribute your insights on this topic so others can benefit.