Accounting

Breaking Down Break Even Analysis Part 2

Written by Farhaa Xha for Gaebler Ventures

This article delves further into the topic and explains breakeven charts, margin of safety and an recommendation on lowering your BEP point.

How do I construct a Break Even Chart?

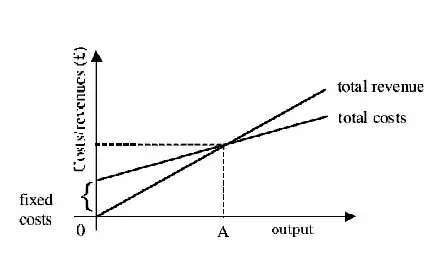

The use of a graph is helpful in break even analysis.

It is possible to identify BEP in plotting the TC (Total Cost) and TR (Total Revenue) equation on the graph. This graph is called break even chart.

Step 1.Mark the horizontal axis to illustrate all levels of production.

Step 2.Mark the vertical axis with values for costs and revenues. Values recorded should range from zero to the maximum possible revenue

Step 3.Sketch a horizontal line to show fixed costs -constant at all levels of output.

Step 4.Add variable costs. This line will start at the origin (zero output /costs). Calculate variable costs at maximum output and mark on graph. Connect the two points with a straight line.

Step 5. Add together FC and VC. Add the values at zero output; the answer will equal fixed cost as variable cost is zero at this output. Next add together fixed and variable costs at maximum output and mark result on graph. Join the two points together.

Step 6. Finally include revenues on the chart. This line will begin at the origin. Calculate the revenue that will be earned at he maximum output and label this point on the graph. A straight line should be drawn from this point to the origin. This is the firm's revenue line. Break even output occurs where the revenue line cuts the total cost line.

What is Margin of Safety?

This is the distance between break even point and the expected or existing level of activity (operation). It represents the amount by which 'actual' activity can fall short of expected activity before a loss is incurred. Firms generally prefer to operate with a large margin of safety - It is an assessment of risk. A current operating business can compare its present level of output (higher than break even output) with the break even output to determine the difference

Margin of safety = Current output - break even level of output

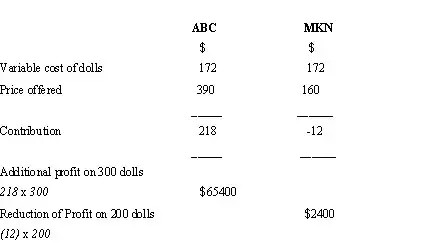

Should we accept an order below normal selling price?For example, ABC company approaches XYZ Ltd with a proposal for a contract that will require an additional production of 300 dolls per month. ABC Company would be prepared to pay $390 for each of the additional dolls produced. At the same time, MKN ltd require XYZ ltd to produce an additional 200 dolls per moth for which they will be prepared to pay $160 per doll .

Assuming variable cost of producing each unit is initially $172

Based on our calculations (only), the offer from MKN should be refused as it lessens our profit.

How Can I lower my Break Even Point?

You cannot incur a profit unless you cover your direct and indirect expenses. In order to lower your break even point you need to consider 'what can be changed or improved?'

You may either concentrate on cost or price, however cost control should always be an on going goal .Any aim to control fixed expense should have an advanced plan in mind, so as to maintain a balance. Cost cutting measures should not exhaust your workers nor hinder necessary marketing initiative which might contribute immensely to your existing operation .

Lowering the direct cost--thereby increasing the unit's contribution margin. This can be done by reviewing your existing strategy towards cost. Being more thorough regarding purchase of inventory, looking for more alternatives way of purchasing, maintaining effective stock control by using stock control techniques might help a lot. Look for ways to improve Productivity of labor e.g. incorporating efficient technology, revising your 'recruiting' strategies or more cost effective scheduling. If you are selling variety of products, you can improve the sales mix by selling a bigger proportion of the products having larger contribution margins.

Increase the selling price? Yes! So long as the number of units sold will not decline significantly. This would involve understanding the market you operate in and the product or service you offer. However, raising the price may not result in the fall your sales unless you operate in a very demand elastic market (i.e. price sensitive, it is important to know the demand elasticity of your product as well).

Break Even analysis is important not only for new business but also for existing business. It helps to understand the impact on our costs as other variables (e.g. selling price) change; therefore it is vital that you regularly calculate your break even point to predict the impact on profit of any minor change.

Farhaa is a student pursuing a concentration in Economics and Finance at London school of Economics and Political Science, University of London. She is passionate about making accounting and economics accessible to entrepreneurs. Farhaa will also be sharing unconventional yet effective ways of recruiting.

Share this article

Additional Resources for Entrepreneurs

Conversation Board

We greatly appreciate any advice you can provide on this topic. Please contribute your insights on this topic so others can benefit.