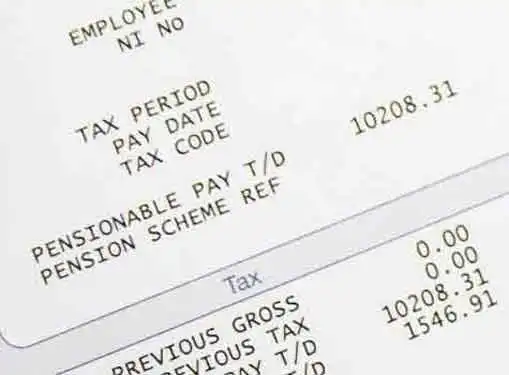

Processing Payroll

Do I Have to Pay Payroll Taxes?

Can't I just write people checks or pay them cash? Do I really need to process payroll? We take a look at small business payroll tax responsibilities.

Do you need to process payroll? Great question!

If you operate a small business and engage employees or independent contractors to assist you, you have payroll responsibilities.

There are numerous tax, employee paperwork, and reporting obligations. The payroll articles on our site will get you up to speed on all of your payroll responsibilities, including the following:

- withholding federal, state and local payroll taxes,

- reporting payroll information to federal, state and local agencies,

- remitting payroll taxes on a regular and timely basis, and

- paying your employees (option of direct deposit)

Just because you are "in business" doesn't mean you have to process payroll. If you are self-employed - a one-man band working alone - you may not have to process payroll.

However, you may still be liable for employment taxes in the form of a self-employment tax.

Even when you do business as a sole proprietor, if you engage employees or independent contractors, you will have payroll responsibilities.

The bottomline is that as soon as you become an employer, you become responsible for withholding taxes from your employees' pay. You are then of course responsible for depositing the withheld amounts with the appropriate tax agencies.

Finally, as an employer, you must pay employer payroll taxes that are calculated based on how much you pay your workers.

Share this article

Additional Resources for Entrepreneurs

Conversation Board

Do you have questions about your payroll tax resposibilities? Post them below and we'll do our best to answer them in a timely manner.