Small Business Marketing News

Illinois Fair Tax Vs. Flat Tax: Small Business Impact

Written by Ken Gaebler

Published: 8/28/2020

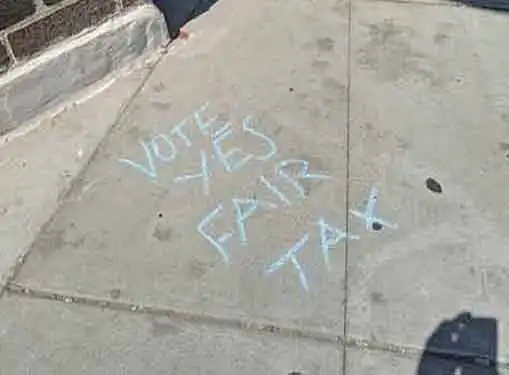

As Illinois prepares to vote on the Fair Tax in November 2020, moving away from an archaic and discredited flat tax method to a graduated tax system, there has been substantial debate over what behavioral impact will result from the change.

Is the Illinois Fair Tax good for small businesses or bad for small businesses?

Looking at what happened in another state after similar state tax system changes is not necessarily the right way to do this, since so many other factors are in play.

Consider, for example, a hypothetical analysis done in 2023 on the impact a switch to the Fair Tax might have had on Illinois in 2021 and 2022.

It would be hard to isolate the impact of any changes to the tax system from the impact of the Covid pandemic, wouldn't you agree?

Since so many factors impact economic results, history is not the best reference for understanding taxation cause and effect.

Instead, it's necessary to run proper experiments where external variables are controlled.

Research Shows Higher Productivity in Fair Tax Economies

That's precisely what researchers Jozsef Pantya, Judit Kovacs, Christoph Kogler and Erich Kirchler did in 2016 when they researched the behavioral implications of alternative taxation systems.

Their study is entitled "Work performance and tax compliance in flat and progressive tax systems," and it debunks two common false beliefs about how tax systems impact our behavior.

The researchers describe the going-in assumptions to be that "the proportional feature of a flat tax system is assumed to lead to higher performance, while the fairness of the redistributive progressive tax system is assumed to result in higher tax compliance."

In other words, many might assume, incorrectly as it turns out, that a flat tax system, where everyone pays the same rate regardless of whether they are rich or poor, results in more motivation and higher economic productivity.

However, the researchers found the opposite when they did a controlled experiment with real people.

Having more motivated workers is good for business owners, small or large, and it's good for workers as well, since, in theory, all boats rise in a higher productivity economy.

Thus, the research seems to suggest the Illinois Fair Tax is good for small business, which is counter to the narrative put out there by opponents to the Illinois Fair Tax. Of course, we also know that the Illinois Fair Tax is good for young entrepreneurs who are not wealthy yet and need tax relief, so this research by Pantya and his team further suggests that the Illinois Fair Tax is a net positive for Illinois small business owners.

Another misperception addressed by the research is that tax compliance will be strongest in a progressive tax system because people will view it as being more equitable.

Again, the experiments and research found this to be false.

There's less compliance (i.e. more cheating) when the system asks the wealthy to pay a higher tax rate on the upper levels of their income.

In short, applied to the Illinoi Fair tax debate, this evidence from a controlled research study suggests that motivation to work and economic productivity will increase throughout Illinois if the Fair Tax is passed.

But, on the flip side, more people, particularly the wealthy, may game their taxes in an effort to pay less. Cheaters gonna cheat. Not all that surprising, really.

Neoclassical Economics vs. The Real World

When a study like this debunks theories from those who have embraced the orthodoxy of neoclassical economics, I'm never surprised.

Time and time again, classic economic theory hasn't proven to be predictive in the real world.

We don't behave in accordance with the math that informs classical economic theory. We're humans, after all.

Sadly, many people still cling to neoclassical economics as gospel, often at the expense of humanity.

To understand just how irrational humans are when it comes to decision making, one need only look at the Illinois Far Tax debate.

Some 97% of the population will get a tax break if the Illinois Fair Tax passes. The state clearly needs the tax revenue to correct several problems, the correction of which will benefit the citizens. In Southern Illinois, where opposition to the Fair Tax is said to be strongest, the additional spending that benefits those Illinois citizens will come largely from taxpayers elsewhere in the state.

All of this suggests that, if we are in fact rational beings, the Fair Tax should have overwhelming support from people in Illinois, regardless of their location.

But the misinformation that is out there about the Fair Tax is scuttling clear thinking.

There's propaganda getting to market that a Fair Tax will decrease people's motivation to grow the economy.

The research cited above debunks that theory, strongly suggesting that the Illinois Fair Tax is good for small businesses, mid-sized business and large businesses, but most people are not spending their time reading academic journals. They are instead clinging to the sacred cows that have been preached to them, often to get them to vote against their own interests or to cause divisiveness within groups that should be allies.

A friend of mine who works in tax policy told me that "The Illinois Fair Tax outcome is not going to be based on a rational analysis of what's best for the people of Illinois. It's like any other campaign. There's going to be a lot of lies, a lot of misinformation and a lot of mudslinging. If it were just about the facts and rational thinking, the Illinois Fair Tax would pass in a heartbeat."

This is the sad state of current affairs. Everyone in Illinois should back the Illinois Fair Tax, and it should win overwhelmingly, but, instead, the vote will be close and every Illinois Fair Tax Yes vote will be critically important this November.

Marketing Takeaways

Marketing in political campaigns is quite different from the business-oriented marketing advice we normally offer, but there are some good parallels and at least one key takeaway.

When a competitor is using disinformation and misinformation to discourage customers from doing business with you, it's important to get the facts out. Towards that effort, academic research can be a useful and powerful tool in countering lies and spin from the competition.

Share this article

About Our News for Small Business Owners

Our entrepreneur news feed is packed with useful information for people who love entrepreneurship. Find helpful entrepreneur resources about small business management, financing, marketing & technology.

Additional Resources for Entrepreneurs