Selling a Business

Prepare for Due Diligence ASAP

It's a good idea to always be prepared to sell your business. That means you need to document and organize all of your contracts well so you can quickly be ready for buyer due diligence.

Sooner or later, you - the small business owner - will be faced with the daunting task of selling your business.

Although you may not yet know who the next owner of your business will be, one thing you can be sure of is that they will want to know as much as they can about your company before they commit to anything.

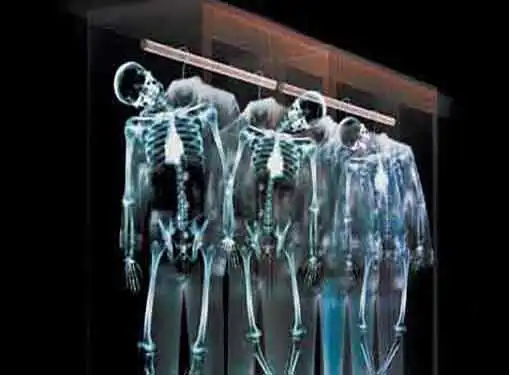

"Due diligence" refers to the information gathering process buyers perform prior to making a commitment to purchase a business. From a sellers' perspective, due diligence is similar to a background check designed to reveal any hidden liabilities or problem areas within the company.

Above all else, there are two things you need to keep in mind when preparing for due diligence.

First, you need to be as thorough as possible. A lack of thoroughness can be construed as an attempt to conceal potential liabilities and can open the door to litigation later on.

Secondly, due diligence preparations need to be made as early as possible to avoid delays in the selling process. The quicker the information can be made available to potential buyers, the more likely it is that your business will sell in a timely manner. With that in mind, here are just some of the things you will need to prepare for the due diligence process.

Personnel Information

Potential buyers will want to know as much as they can about your current employees. Typically, they will want to review the skill sets and experience of individual, key employees, as well as payroll commitments, benefits packages, and other HR material.

Assets

Asset values represent a significant part of the asking price for a business. Buyers will not only want to personally inspect the business' property and equipment, but also understand the rationale behind the valuation process. To prepare for this, you will most likely need to conduct a professional appraisal of the business' major assets including real estate, equipment, and inventory.

Finances

A comprehensive financial review is an integral component of due diligence. Like it or not, you need to be ready to open your books to potential buyers so make sure you have an accurate balance sheets, earnings statements, and possibly even cash flow reports going back several years. Since most buyers will also want to talk about product pricing, you should also be prepared to talk about your pricing policy and where it falls in the marketplace.

Operations

The new owner may or may not approach operations the same way you do. But either way, they will need to understand current processes and procedures to determine the business' viability under their ownership. Vendor relationships, ordering procedures, inventory management, management systems, customer relations - everything that relates to the day-to-day operation of your company is fair game in the due diligence process.

The bottom line is that due diligence can be a far-ranging process of discovery for buyers. The best way to prepare for due diligence is to put yourself in the buyer's shoes and prepare to disclose all of the information you would need to review if you were buying your business.

Share this article

Additional Resources for Entrepreneurs

Conversation Board

We greatly appreciate any advice you can provide on this topic. Please contribute your insights on this topic so others can benefit.